In today’s world of digital payments and online transactions, tools like Privacy Virtual Cards offer a secure and private way to manage spending without sharing your real banking information. Still, there may come a time when you want to move on. Whether you’re simplifying your financial tools or trying a new secure method of payment, knowing how to cancel your Privacy.com account is essential. This guide explains the entire process of ending your subscription, resolving pending activity, and contacting customer service for any issues you may face.

What Is Privacy.com and Why People Close Their Accounts

How To Cancel Privacy Account lets users create virtual debit cards that shield their real bank details when shopping online. These Privacy Virtual Cards enhance online security by acting as a firewall between your money and the internet. Features like merchant locking, spending limits, and one-time use cards help guard against fraud and unauthorized charges.

Despite the benefits, some users decide to terminate their account. They may be moving to a different payment tool, no longer use the service, want fewer financial accounts to manage, or have concerns about inactive accounts and data. Founded in 2015 and based in New York, Privacy.com serves more than a million users who rely on it for safer digital transactions. But if you’re ready to discontinue service, here’s how to do it the right way.

Know This Before You Cancel Privacy Account

Canceling a Privacy account is permanent. Once deleted, your profile, card history, and settings can’t be recovered. You will lose access to all virtual cards, and your linked bank will be disconnected. Any ongoing or future payments scheduled through your virtual cards will be stopped. Refunds that haven’t been completed may be disrupted. Privacy.com may still retain some personal data for legal compliance.

If there are any unresolved transactions or refunds in progress, be sure to clear those up first. Once the account is gone, there is no going back.

How To Cancel Privacy Account on Desktop and Mobile

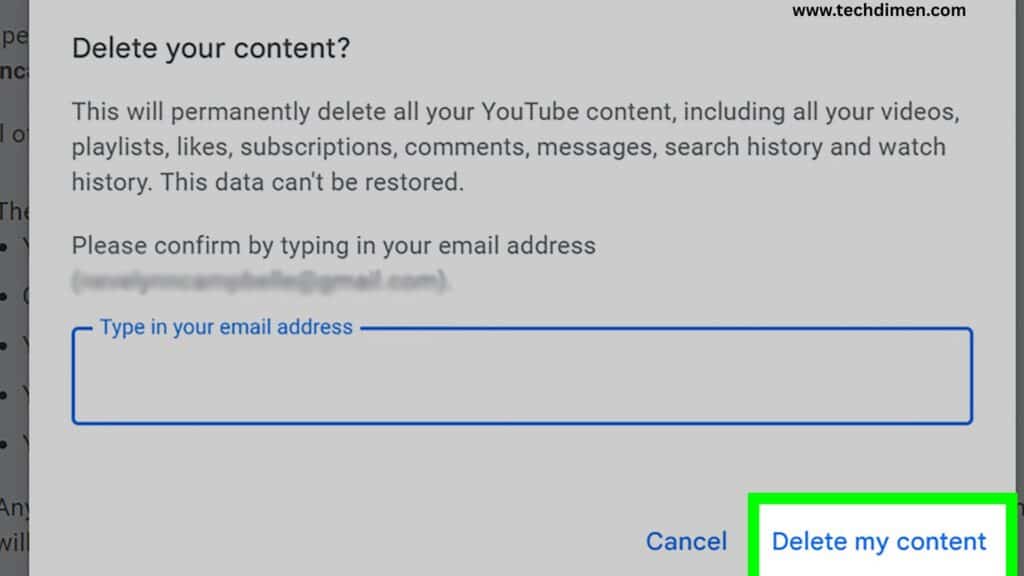

If you have access to your account, canceling is easy. On a desktop, sign in at Privacy.com. Click your profile icon and go to Settings, then choose Account. At the bottom of the Account page, select the Close Account option. Privacy will send a confirmation email to verify the cancellation.

On mobile, log into the app. Tap the settings icon, go to Account, and choose Close Account. The same email verification process applies here too. If you can’t sign in, contact with the email tied to your account. Include your name and reason for closing. If possible, add recent transaction details to help verify your identity.

Can You Pause or Deactivate Your Account Instead

How To Cancel Privacy Account does not allow temporary pauses or deactivations. You can’t freeze your account for later reactivation. What you can do instead is lock your virtual cards, unlink your bank, and stop using the service. This method keeps your account technically open but disables activity.

Some users prefer this if they’re unsure about canceling for good. It allows them to keep past data and return when needed, without triggering account termination.

Quick Summary of Privacy.com Account Cancellation

| Action | What Happens |

|---|---|

| Account Deletion | Permanently removes access to account and virtual cards |

| Refunds After Closure | May be lost if not processed before cancellation |

| Account Recovery | Not possible after deletion |

| Reactivation Option | Not possible after deletion |

| Temporary Pause Available | No; only manual deactivation by unlinking or card locking |

What Happens After You Cancel Privacy Account

When your account is closed, all virtual cards stop working. Any scheduled payments or charges will be automatically denied. Refunds that haven’t gone through may bounce. You will be locked out of your dashboard. However, the support team can still help with limited refund issues after closure. Virtual cards vanish. Transactions stop. Bank connections break. Your login credentials won’t work anymore. Yet if you need help, email support still works.

Refund Process Explained

If a merchant processes a refund while your account is still active, the money goes to your linked bank account. But once the account is canceled, the refund may not complete. Privacy cannot transfer refunds to closed accounts or reissue them afterward.

So if you’re expecting any money back, make sure those refunds clear before closing your account. Unsure about timing? Email support to confirm the transaction status before you proceed.

Merchant Cancellations and Failed Refunds

If a merchant cancels a transaction before settlement, that amount should return to your account automatically. If the cancellation happens after you delete your account, the refund might fail or return to the merchant.

In cases where the merchant can’t cancel or refuses to process a refund, you have a few options. Start by contacting the merchant directly. If they won’t cooperate, escalate the matter by disputing the charge through your bank. You can also email Privacy support and request help initiating the transaction dispute process. When challenging a transaction, prepare documentation. Include the merchant name, purchase date, amount, and communication history. The more details you provide, the easier it is to resolve the issue.

How to Contact Privacy Customer Service

How To Cancel Privacy Account doesn’t offer phone support, but their email assistance is prompt. To get help, send a message to . Include your registered email, a clear explanation of your issue, and supporting information if you have it. You can also visit their help center on the website. For quick updates, follow @PrivacyHQ on Twitter. Most users receive a reply within two business days, though urgent issues may be handled faster.

Alternatives to Canceling Your Privacy Account

If you’re not ready to say goodbye completely, there are other ways to manage your account. Deleting unused virtual cards can eliminate unnecessary activity. Turning off automatic funding from your bank prevents future transactions. Unlinking your funding source disables your ability to spend.

These actions let you pause your use of the platform without losing your account entirely. It’s a practical choice if you think you might need the service again.

FAQs

Can I reopen my Privacy.com account after closing it?

No, once your Privacy account is permanently closed, it cannot be reopened. You would need to create a new account from scratch using a new setup. All your old Privacy Virtual Cards and transaction history will be deleted.

Will canceling my Privacy account affect my credit score?

Not at all. Privacy.com doesn’t rely on or report to credit bureaus. Since it operates using debit-based funding sources, your credit file remains untouched.

How do I ensure I get my refunds before I cancel?

Before you terminate your account, check your recent transactions for any pending merchant refunds. Contact the merchant directly or confirm with the Privacy support team to verify the refund status. Refunds cannot be processed once the account is closed.

What should I do if I can’t log in but want to cancel my account?

If you’re locked out, send an email to the Privacy customer service team. Use the email linked to your account and include identifying details such as your name, last few transaction amounts, or dates. This helps verify your identity and start the account cancellation process securely.

Can I temporarily disable my account instead of deleting it?

Privacy.com doesn’t offer a pause feature, but you can stop activity by locking all your virtual cards and unlinking your funding source. This effectively freezes your spending while keeping your account intact.

What happens if a merchant issues a refund after my account is canceled?

If your account is closed, Privacy can’t credit the funds back to you. In many cases, the money is returned to the merchant, and you’ll have to contact them for a new resolution. That’s why it’s best to wait until all pending refunds are finalized.

How do I file a dispute for an unauthorized charge?

You can start the transaction dispute process by emailing Privacy support with detailed information. Include merchant name, transaction amount, date, and why you believe the charge is unauthorized. The support team will guide you through the chargeback process and help secure your funds if possible.

Do I still get fraud protection after canceling my account?

Once your account is closed, Privacy’s fraud prevention and unauthorized charges protection no longer apply. However, if an issue happened before the cancellation and remains unresolved, their team may still assist through email customer support.

Is there a faster way to contact the support team?

Currently, the only official method is email. They don’t have phone or live chat, but you can expect a response within two business days. For basic updates, their Twitter account @PrivacyHQ may also post announcements or alerts.

Final Thoughts

Canceling your Privacy.com account is a serious step that cuts off access to a secure payment tool built for fraud prevention. Make sure to handle outstanding refunds, subscriptions, and scheduled charges first. The process is easy if you follow the correct steps, and the customer support team is available to help should anything go wrong. If you’re canceling due to inactivity or concern about online security, consider locking your cards or disconnecting your bank as a less permanent solution. Either way, make an informed choice that fits your digital lifestyle.

Jhon AJS is a tech enthusiast and author at Tech Dimen, where he explores the latest trends in technology and TV dimensions. With a passion for simplifying complex topics, Jhon aims to make tech accessible and engaging for readers of all levels.