the Financial Challenges Patients Face

Optimizing Patient Payment Plans for Higher Revenue, Many patients struggle with paying medical bills due to high healthcare costs, lack of financial planning, and unexpected medical emergencies. According to a report by the Kaiser Family Foundation, nearly 41% of adults in the U.S. have some form of medical debt. Understanding these financial burdens is crucial for designing effective patient payment plans that ease their stress while ensuring healthcare providers receive timely payments.

Rising Healthcare Costs and Their Impact

The increasing cost of healthcare places a heavy burden on patients, making it difficult to access essential medical services. From routine checkups to life-saving procedures, financial barriers often lead to delayed treatment, mounting debt, and emotional distress.

Out of Pocket Expenses: A Major Concern

High Deductibles and Co Pays

Even with health insurance, many patients must cover substantial costs before receiving full coverage. High deductibles, co-pays, and co-insurance fees make necessary treatments unaffordable for many, forcing individuals to postpone or avoid medical care.

The Cost of Routine and Specialized Care

Primary care visits, specialist consultations, diagnostic tests, and emergency room visits come with significant price tags. Without adequate financial resources, patients often struggle to afford even basic healthcare services.

The Struggles of Being Uninsured or Underinsured

Limited Coverage Options

Millions of individuals lack comprehensive health insurance, leading to high out-of-pocket expenses. Many insurance plans offer minimal coverage, exclude essential treatments, or impose high maximum limits, leaving patients vulnerable to excessive medical bills.

The Financial Burden of Chronic Conditions

Patients with long-term illnesses, such as diabetes or heart disease, face continuous healthcare costs. Without sufficient insurance coverage, managing chronic conditions becomes financially overwhelming, leading to poor health outcomes.

Medical Debt: A Leading Cause of Bankruptcy

The Hidden Costs of Hospital Stays

A single hospital stay or surgical procedure can result in thousands of dollars in expenses. Many patients are unaware of the full cost of their treatment until they receive the final bill, adding to their financial distress.

The Consequences of Unpaid Medical Bills

Unpaid medical bills can lead to debt collection, credit score damage, and even bankruptcy. Many families struggle to balance medical expenses with other financial responsibilities, creating long-term economic hardship.

The Rising Cost of Prescription Medications

The Struggle to Afford Essential Drugs

Prescription drug prices continue to rise, making it difficult for patients to afford necessary medications. Many individuals are forced to skip doses, ration prescriptions, or seek alternative treatments that may be less effective.

Seeking Alternative Solutions

Some patients turn to international sources or discount programs to access affordable medications. While these options can provide temporary relief, they do not address the larger issue of high drug pricing within the healthcare system.

The Indirect Financial Impact of Illness

Lost Income and Job Insecurity

Severe or chronic illnesses often prevent individuals from maintaining steady employment. Frequent medical appointments, recovery periods, and long-term treatments reduce earning potential and job stability.

The Strain on Family Finances

When a patient is unable to work, their family members may need to take on additional financial responsibilities. The loss of income, combined with rising medical costs, can push entire households into economic hardship.

Mental and Emotional Toll of Financial Hardship

The Stress of Medical Debt

Financial struggles related to healthcare often lead to anxiety and depression. The fear of accumulating medical bills, combined with uncertainty about future treatment costs, creates a significant emotional burden.

The Cycle of Poor Health and Financial Struggles

Patients who cannot afford proper treatment often experience worsened health outcomes, leading to even higher medical costs in the long run. This cycle of financial and physical distress makes it difficult for individuals to regain stability.

Solutions to Reduce Financial Strain

Exploring Financial Assistance Programs

Many hospitals and nonprofit organizations offer financial aid programs to help patients manage medical expenses. Researching these options can provide relief for those facing overwhelming healthcare costs.

Negotiating Medical Bills and Payment Plans

Patients can often negotiate their medical bills or arrange payment plans with healthcare providers. Understanding billing policies and seeking assistance can help reduce the financial burden of treatment.

Advocating for Systemic Change

Access to affordable healthcare remains a critical issue. While individual strategies can help mitigate costs, broader systemic reforms are needed to ensure that all patients receive necessary medical care without facing financial ruin.

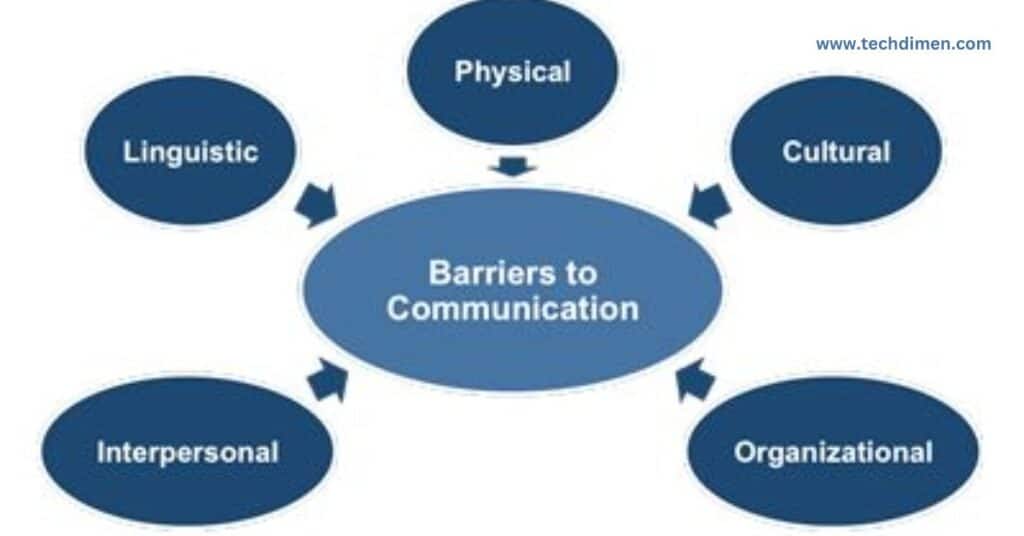

Addressing Common Barriers to Payment

Patients often miss payments due to high out-of-pocket costs, lack of insurance coverage, or inflexible payment structures. Many also struggle with understanding their bills, leading to confusion and delays. Hospitals and clinics can mitigate these challenges by providing clear cost breakdowns, flexible installment options, and pre-treatment financial counseling.

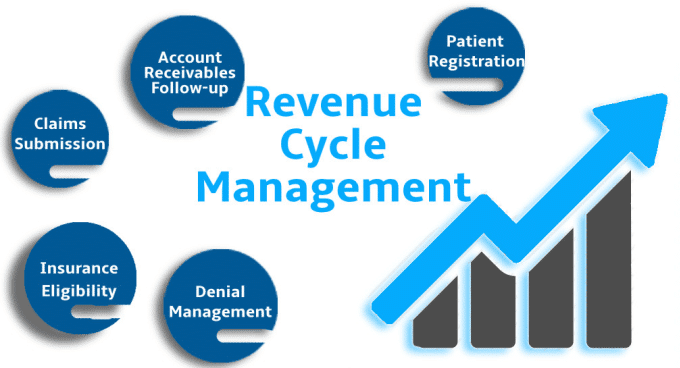

Enhancing Revenue Cycle Management

A well-structured revenue cycle management system ensures a steady cash flow while fostering patient trust. Proactively estimating costs, verifying insurance coverage early, and following up with patients before due dates can prevent non-payment. By integrating these strategies, healthcare providers can significantly reduce the number of outstanding balances.

Establishing Clear Payment Expectations

Transparent communication about payment responsibilities helps patients plan their finances better. Providing itemized bills, explaining coverage limitations, and offering financial counseling before treatment can lead to higher compliance rates. A study by the American Hospital Association found that upfront cost discussions led to a 30% increase in on-time payments.

Designing Flexible and Patient-Centric Payment Plans

Rigid payment structures often result in non-payment or delayed settlements. By offering customized installment plans, interest-free financing, and multiple payment channels such as digital wallets and auto-pay options, providers can make it easier for patients to meet their financial obligations. These solutions cater to different financial situations and improve overall revenue collection.

Leveraging Technology for Seamless Payment Collection

Modern billing systems simplify the payment process and improve efficiency. Automated reminders help reduce missed payments, while online portals enable patients to track bills and make payments conveniently. Mobile payment options enhance accessibility, particularly for younger patients. AI-driven billing solutions can predict and prevent delinquencies by analyzing payment trends and identifying at-risk accounts.

Empowering Staff to Facilitate Payment Conversations

Properly trained staff can make a significant difference in payment collection. When front-desk teams are equipped to discuss financial matters with confidence, patient trust increases, and billing disputes decrease. A Texas-based hospital that implemented financial communication training saw a 20% improvement in patient payment compliance, demonstrating the impact of clear, empathetic interactions.

Implementing Proactive Strategies to Reduce Defaults

Preventing payment defaults requires early intervention. Healthcare providers can use predictive analytics to identify at-risk patients and offer financial assistance programs tailored to their needs. Engaging patients with reminders before due dates and providing flexible restructuring options can further reduce non-payment rates.

Simplifying the Billing Process for Better Patient Experience

Clear and concise billing statements reduce confusion and encourage prompt payments. Using plain language to explain charges, highlighting payment options prominently, and offering multiple channels for support—such as phone assistance, online chat, and in-person consultations—improves patient satisfaction. A survey by RevCycle Intelligence found that 75% of patients prefer digital billing over paper statements, indicating the importance of modernizing payment processes.

Fostering Financial Transparency and Trust

Building trust in the billing process requires openness about costs and available payment solutions. Patients should be able to compare pricing, access detailed cost breakdowns, and receive personalized financial counseling when needed. When providers are transparent about fees and payment options, patients are more likely to fulfill their obligations without delays.

Measuring and Refining Payment Strategies

Continuous monitoring of payment trends ensures that healthcare providers optimize their revenue collection efforts. Key performance indicators such as collection rates, patient satisfaction scores, accounts receivable turnover, and default rates help identify areas for improvement. Regularly assessing these metrics allows providers to refine their strategies and enhance patient financial engagement.

Future Trends in Patient Payment Optimization

The healthcare payment landscape is evolving with emerging technologies such as blockchain for secure transactions, AI-driven predictive analytics, and fintech integrations for real-time payments. Subscription-based healthcare payment models are also gaining traction, offering patients predictable and manageable billing structures. Adopting these innovations can further streamline revenue collection and enhance the patient experience.

FAQs: optimizing Patient Payment Plans for Higher Revenue

1. Why is patient payment optimization important for healthcare providers?

Optimizing patient payment plans ensures timely revenue collection, reduces bad debt, and improves the overall financial health of healthcare facilities while enhancing patient satisfaction.

2. What are the biggest financial challenges patients face when paying medical bills?

Patients often struggle with high out-of-pocket costs, lack of insurance coverage, unexpected medical expenses, and difficulty understanding complex billing statements.

3. How can healthcare providers make medical bills easier to understand?

Providers can use plain language, provide itemized bills, offer cost estimates upfront, and use digital tools to simplify statements and improve transparency.

4. What flexible payment options can providers offer patients?

Healthcare providers can offer interest-free installment plans, auto-pay options, digital wallets, medical credit lines, and subscription-based healthcare payment models.

5. How does technology improve patient payment collections?

Automated billing systems, AI-driven reminders, online payment portals, and mobile payment solutions make it easier for patients to pay on time and reduce missed payments.

6. What role does financial counseling play in improving patient payments?

Pre-treatment financial counseling helps patients understand their costs, explore payment options, and create personalized plans to avoid unexpected financial burdens.

7. How can healthcare facilities prevent payment defaults?

By using predictive analytics, proactive patient outreach, flexible restructuring options, and automated payment reminders, providers can minimize defaults.

8. Why is financial transparency important in medical billing?

Clear cost breakdowns, upfront pricing, and transparent policies build trust with patients and encourage timely payments while reducing billing disputes.

9. What are the benefits of offering digital payment options?

Digital payments provide convenience, reduce administrative workload, increase on-time payments, and cater to tech-savvy patients who prefer online transactions.

10. How can staff training improve payment collections?

Training front-desk and billing staff in empathetic financial communication ensures they can confidently discuss payment options, reducing disputes and enhancing patient trust.

11. What strategies can hospitals use to reduce outstanding balances?

Hospitals can improve collections by offering multiple payment methods, providing early cost estimates, following up with patients, and integrating financial assistance programs.

12. How do AI and predictive analytics help with patient payments?

AI tools analyze patient payment behavior, predict delinquencies, send automated reminders, and suggest tailored payment plans to improve revenue collection.

13. How does patient satisfaction impact payment compliance?

Satisfied patients are more likely to pay their bills on time, especially when they experience clear communication, financial transparency, and flexible payment options.

14. What are the future trends in patient payment optimization?

Innovations such as blockchain for secure transactions, fintech integrations, AI-driven billing solutions, and subscription-based healthcare payments are shaping the future of medical billing.

15. How can healthcare providers measure the success of their payment strategies?

Tracking key metrics like collection rates, patient satisfaction, accounts receivable turnover, and default rates helps providers refine their payment strategies for better results.

Conclusion: optimizing Patient Payment Plans for Higher Revenue

Optimizing Patient Payment Plans for Higher Revenue is essential for balancing financial stability with patient satisfaction. By leveraging technology, offering flexible payment options, training staff for financial conversations, and maintaining transparency, healthcare providers can create a sustainable revenue collection system. Implementing these strategies ensures that both patients and providers benefit from a more efficient and accessible healthcare billing process.

Implementing effective patient payment plans is crucial for improving revenue collection and reducing financial strain on healthcare providers. By offering flexible payment options, clear billing communication, and automated payment solutions, healthcare facilities can enhance patient satisfaction while ensuring steady cash flow.

Key strategies include personalized payment plans, leveraging digital payment systems, ensuring transparent pricing, and actively educating patients on their payment responsibilities. Additionally, integrating AI-driven billing solutions and optimizing for insurance coordination can streamline collections and minimize delays.

Ultimately, a well-structured payment plan not only benefits the provider by reducing outstanding balances and improving financial stability but also helps patients manage their medical expenses with greater ease. By continuously analyzing and refining payment processes, healthcare facilities can boost revenue collection efficiency and foster long-term patient trust.

Jhon AJS is a tech enthusiast and author at Tech Dimen, where he explores the latest trends in technology and TV dimensions. With a passion for simplifying complex topics, Jhon aims to make tech accessible and engaging for readers of all levels.